Indicators on Frost Pllc You Should Know

Indicators on Frost Pllc You Should Know

Blog Article

Some Ideas on Frost Pllc You Need To Know

Table of ContentsUnknown Facts About Frost PllcFrost Pllc Can Be Fun For EveryoneThe smart Trick of Frost Pllc That Nobody is DiscussingThe Facts About Frost Pllc RevealedThe 8-Minute Rule for Frost Pllc

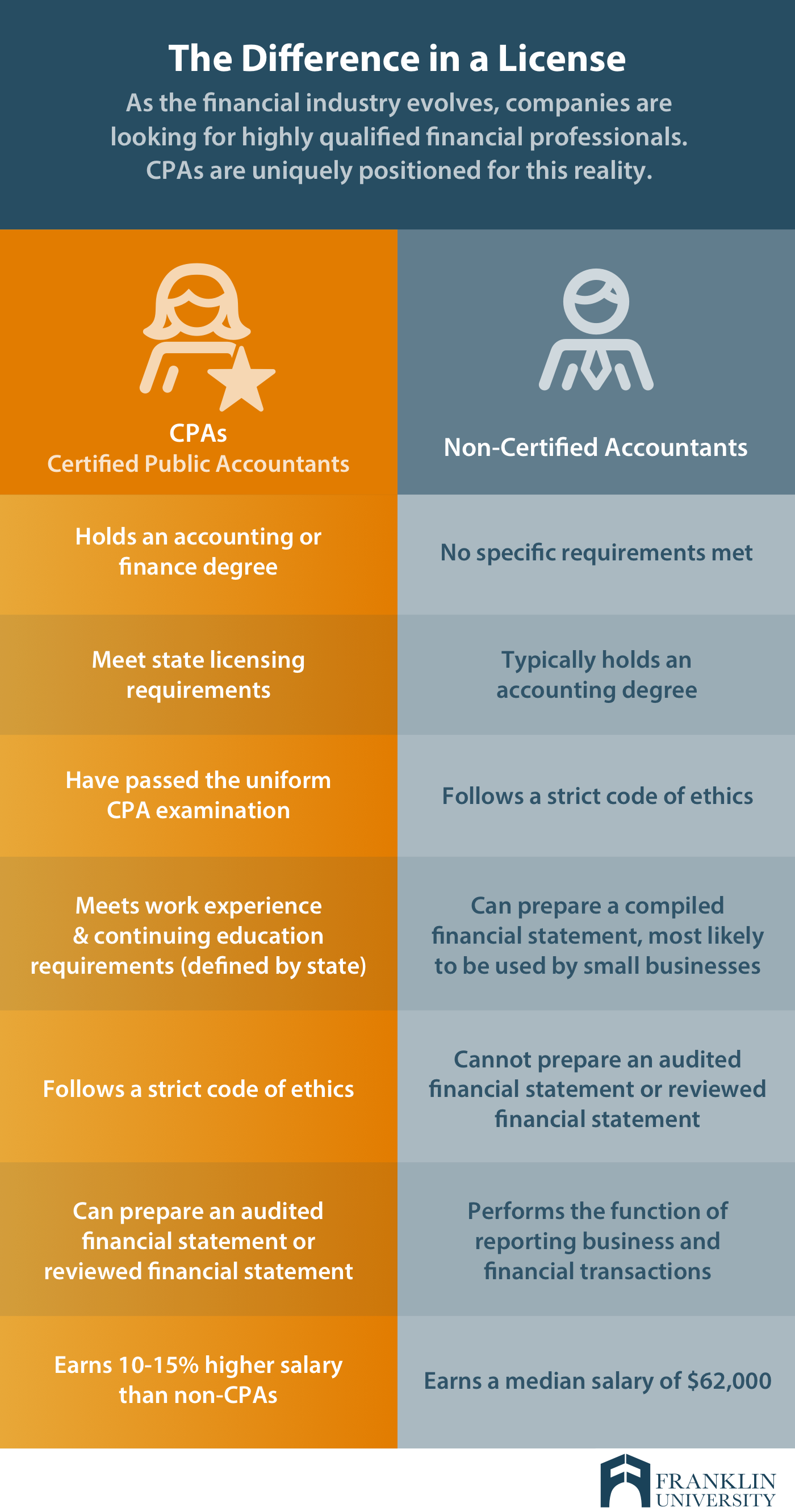

Certified public accountants are among the most relied on careers, and permanently factor. Not just do CPAs bring an unrivaled level of expertise, experience and education and learning to the process of tax planning and managing your cash, they are specifically trained to be independent and unbiased in their work. A certified public accountant will aid you secure your interests, pay attention to and resolve your concerns and, just as vital, provide you satisfaction.Working with a neighborhood CPA company can favorably influence your business's monetary health and success. A local CPA firm can aid decrease your service's tax obligation worry while making sure compliance with all suitable tax obligation legislations.

This growth reflects our devotion to making a positive impact in the lives of our clients. When you function with CMP, you end up being component of our family members.

The Best Guide To Frost Pllc

Jenifer Ogzewalla I've worked with CMP for several years currently, and I've actually appreciated their competence and effectiveness. When auditing, they function around my timetable, and do all they can to preserve connection of employees on our audit. This conserves me energy and time, which is very useful to me. Charlotte Cantwell, Utah Celebration Opera & Music Theater For extra motivating success tales and comments from local business owner, click on this link and see just how we've made a distinction for companies like yours.

Here are some key concerns to lead your choice: Check if the CPA holds an active license. This guarantees that they have actually passed the required exams and meet high honest and professional criteria, and it shows that they have the credentials to manage your financial matters properly. Confirm if the certified public accountant supplies services that line up with your service needs.

Tiny organizations have unique monetary needs, and a Certified public accountant with relevant experience can give more tailored recommendations. Ask concerning their experience in your sector or with businesses of your dimension to ensure they recognize your particular obstacles.

Make clear exactly how and when you can reach them, and if they supply routine updates or consultations. An available and responsive CPA will certainly be important for timely decision-making and assistance. Employing a regional CPA firm is more than simply outsourcing monetary tasksit's a wise financial investment in your company's future. At CMP, with offices in Salt Lake City, Logan, and St.

Excitement About Frost Pllc

An accountant that has passed the certified public accountant examination can represent you before the IRS. Certified public accountants are certified, accounting experts. CPAs may function for themselves or as component of a company, depending on the setup. The cost of tax preparation might be reduced for independent specialists, yet their expertise and capability may be much less.

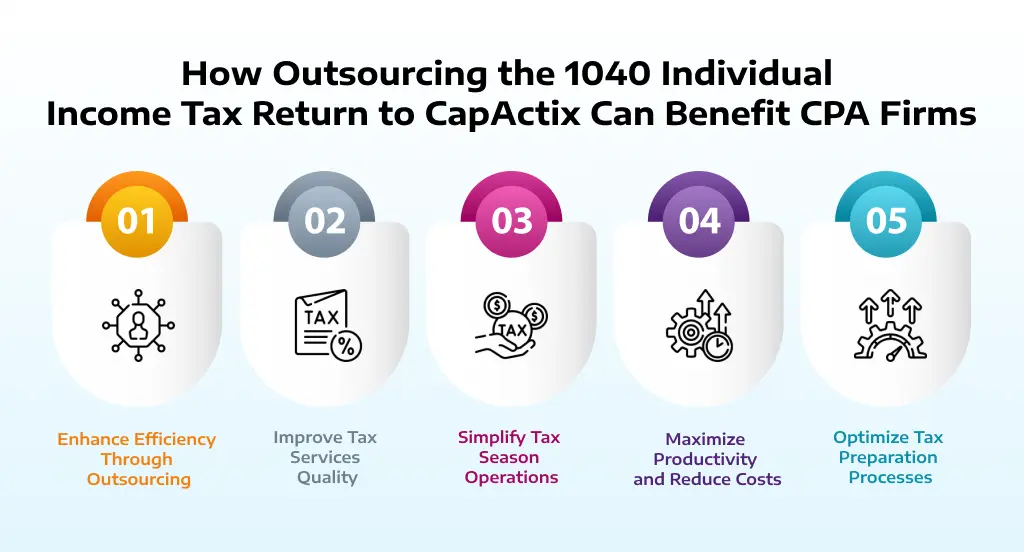

documents to a company that specializes in this location, you not only totally free yourself from this lengthy job, yet you additionally complimentary yourself from the risk of making errors that might cost you economically. You may not be making use of all the tax obligation financial savings and tax obligation deductions available to you. The most essential concern to ask is:'When you save, are you placing it where it can expand? '. Many companies have actually implemented cost-cutting measures to reduce their overall expenditure, but they have not place the cash where it can assist business expand. With the aid of a certified public accountant firm, you can make the most informed decisions and profit-making techniques, taking into account one of the most current, current tax guidelines. Federal government agencies at all degrees require documents and compliance.

The Basic Principles Of Frost Pllc

Handling click now this responsibility can be an overwhelming task, and doing something wrong can cost you both economically and reputationally (Frost PLLC). Full-service certified public accountant companies are acquainted with filing demands to guarantee your company adhere to government and state laws, as well as those of banks, capitalists, and others. You may require to report extra earnings, which may need you to file an income tax return for the very first time

team you can rely on. Get in touch with us to find out more concerning our services. Do you understand the accounting cycle and the actions associated with making sure appropriate economic oversight of your organization's monetary health? What is your business 's legal framework? Sole proprietorships, C-corps, S corporations and partnerships are exhausted in different ways. The more facility your revenue resources, venues(interstate or international versus neighborhood )and market, the more you'll require a CPA. CPAs have a lot more education and learning and undertake an extensive qualification process, so they cost even more than a tax preparer or bookkeeper. On standard, small companies pay between$1,000 and $1,500 to employ a CERTIFIED PUBLIC ACCOUNTANT. When margins are tight, this expenditure might beunreachable. The months before tax day, April 15, are the busiest season for CPAs, followed by the months before completion of the year. You may have to wait to obtain your questions responded to, and your tax return could take longer to finish. There is a limited number of Certified public accountants to walk around, so you may have a difficult time locating one specifically if you have actually waited up until the eleventh hour.

CPAs are the" huge guns "of the bookkeeping industry and normally don't deal with daily bookkeeping jobs. Frequently, these other kinds of accounting professionals have specialties across locations where having a CPA license isn't required, such as administration accounting, nonprofit accountancy, expense audit, federal government accounting, or audit. As an outcome, using a bookkeeping services firm is often a far better value than working with a CERTIFIED PUBLIC ACCOUNTANT

firm to company your sustain financial management effortsAdministration

Certified public accountants likewise have know-how in creating and improving business plans and treatments and evaluation of the useful requirements of staffing models. A well-connected Certified public accountant can take advantage of their network to help the organization in numerous tactical and speaking with roles, successfully linking the organization to the ideal candidate to satisfy their needs. Next time you're looking to fill up a board seat, think about getting to out to a Certified public accountant that can bring worth to your company in all the ways provided above.

Report this page